WE TRANSFORM BUSINESS NEEDS INTO SOLUTIONS THAT GROW WITH YOUR BUSINESS.

Lending Services

We create opportunities for financial professionals and their clients to access cash while retaining portfolio assets.

Deposit Services

Our checking and deposit accounts integrate everyday financial management into broader wealth management strategies.

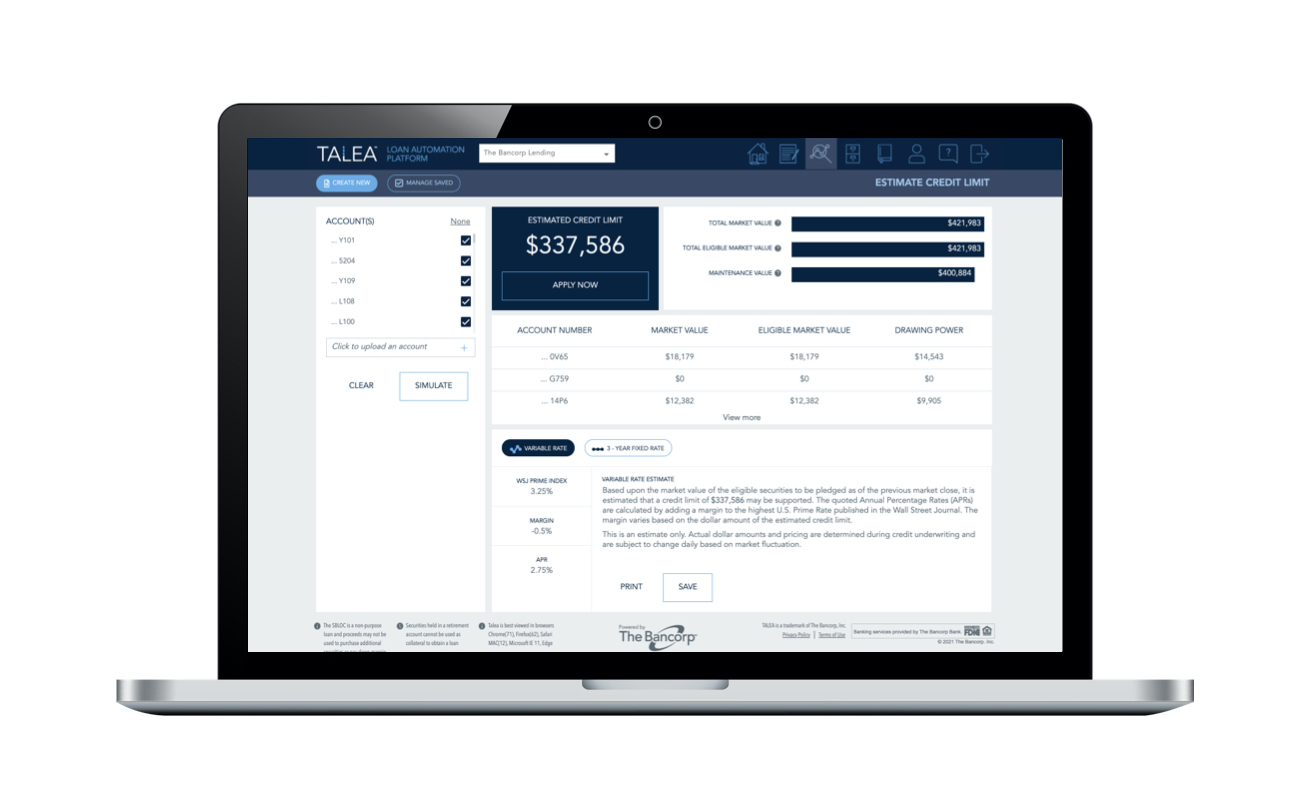

TALEA® LOAN AUTOMATION

Advanced technology and proprietary processes streamline loan origination for a fast and easy client experience.

Lending Services for Financial Professionals

The Bancorp Institutional Banking business is your partner for liquidity solutions that can create financial flexibility for your clients and support your personal practice needs. Our comprehensive offering includes Securities- and Insurance-Backed Lines of Credit as well as conventional loans — all made easier with streamlined processes that can reduce time to funding.

Financial professionals looking to transition their practice with a conventional loan will also receive expert guidance from SkyView® Partners, a consultancy focused on helping financial professionals find competitive and customized bank financing.

The Bancorp lending solutions make borrowing both cost-effective and efficient. Visit our Institutional Banking microsite for more information.