WE TRANSFORM BUSINESS NEEDS INTO SOLUTIONS THAT GROW WITH YOUR BUSINESS.

What Market Volatility Means for The Bancorp SBLOC

While market volatility has financial professionals and their clients concerned about portfolio assets, The Bancorp designed the SBLOC to help clients' pledged assets weather market turbulence.

Volatile financial markets have become a concern for financial professionals and their clients alike. Over the past several months, critical economic indicators and geopolitical events have generated a “perfect storm” of uncertainty in global markets.

- In March, inflation surged to a 40-year high of 7.9%.¹

- That same month, already high gas prices rose further due to the Russian invasion of Ukraine, resulting in a 30% spike from the year prior.²

- In March and May, the Federal Reserve raised interest rates by 0.25% and 0.50% respectively — the first rate increases since 2018 — and indicated the need for additional rate hikes in 2022.³

- With rising interest rates making bonds more valuable, tech giants (Apple, Amazon, Alphabet, and Microsoft) representing over 20% of the S&P 500 have reported double-digit stock drops this year.⁴

These events, accompanied by the continued COVID-19 supply-chain and labor shortages, have contributed to a 67% increase in the “fear index” (The CBOE Volatility Index) compared to last year.⁵

With all of this uncertainty, it’s natural for financial professionals and their clients to be concerned about the portfolio assets pledged for their Securities-Backed Lines of Credit (SBLOCs). However, you can rest assured that The Bancorp Institutional Banking Team closely monitors your clients’ assets.

The Bancorp Conservative Lending Rates

The Bancorp designed the SBLOC to promote the protection of your clients’ pledged collateral. While some banks will offer high advance rates to secure your clients’ business, they may be inclined to liquidate clients’ assets during volatile markets to preempt their losses.

Unlike other banks, The Bancorp offers conservative advance rates based on high-quality, eligible assets in a client’s portfolio.

- Publicly traded with daily pricing

- Not classified as restricted or control stock

- Make up 50-65% of the portfolio value depending on its structure

- Offer a 50-95% advance rate depending on asset type⁶

The Bancorp has developed our collateral requirements to provide a buffer between the SBLOC advance rate and the potential default rate, reducing the potential for clients to liquidate assets at a loss.

Daily Collateral Monitoring & Valuation

The Bancorp Institutional Banking Team is your partner for promoting your clients’ portfolio health. Every business day, our Collateral Analyst Team monitors financial markets to determine the current value of your clients’ assets. This proactive approach to collateral management offers early detection of changes in the value of your clients’ pledged assets well before the collateral reaches default status.

Our documented process for monitoring portfolios includes a three-tier system based on the value of a client’s assets against their current SBLOC outstanding balance.

- No/low outstanding account balance relative to the client’s collateral limit. There is no action required.

- The loan value exceeds the collateral limits (“top-up” status). While liquidation is not required, the financial professional needs to take action to rectify the imbalance.

- The loan balance exceeds portfolio value. As a result, the financial professional needs to intervene to prevent portfolio liquidation.

The portfolio tiers create measurable checkpoints to indicate when our Collateral Analyst Team needs to contact a financial professional. Unlike some lenders, The Bancorp doesn’t believe in sudden portfolio liquidations. Instead, our goal is to keep the portfolio in the hands of financial professionals and their clients. We initiate contact with financial professionals when a client's collateral balance reaches “top-up” status. This direct and timely contact gives financial professionals time to work out a solution with their clients and keep their client relationships intact.

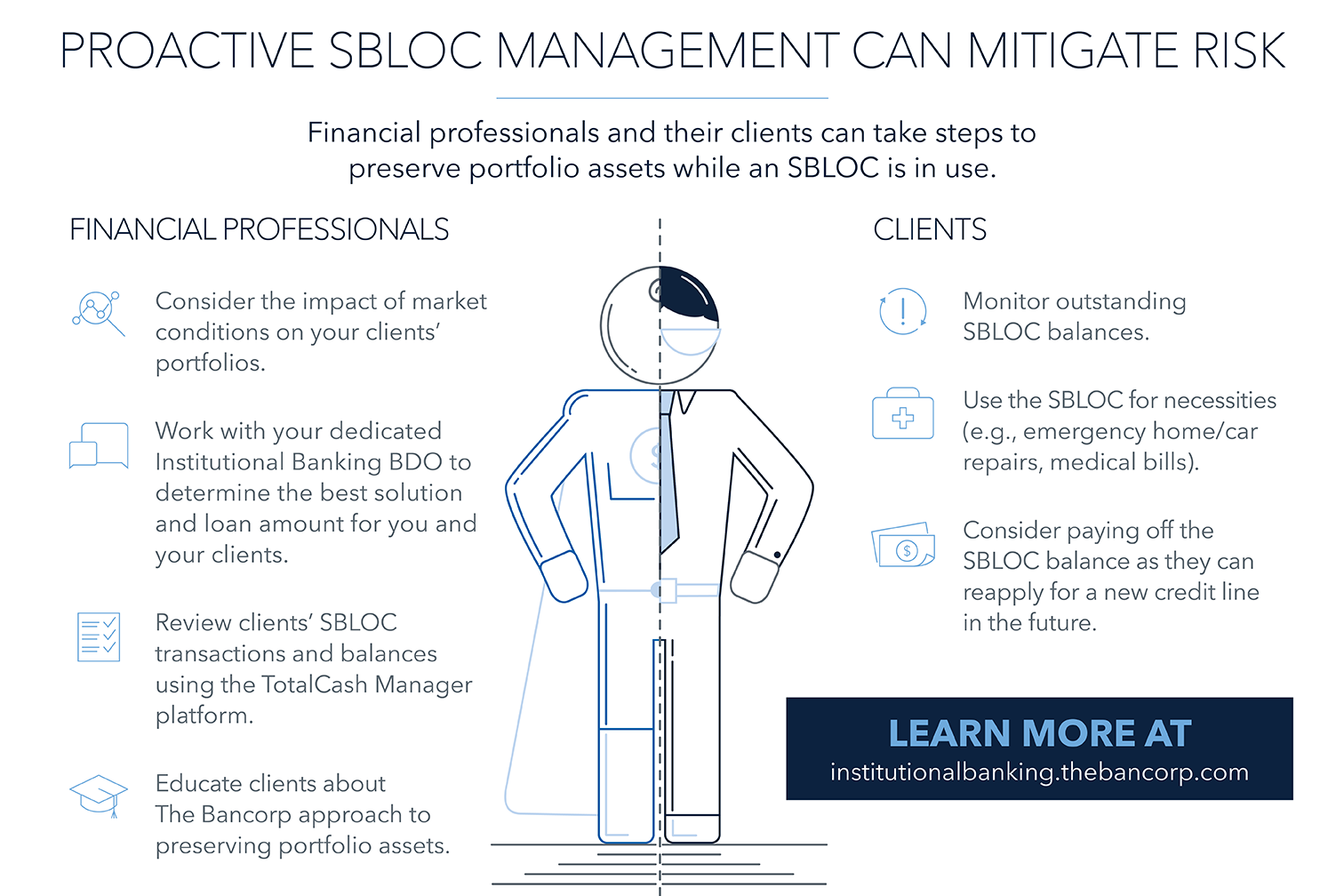

Financial Professionals and Clients Can Also Take Action to Preserve Pledged Assets

Financial professionals know that actively managing clients’ debt is equally important as managing their assets. When your clients have outstanding SBLOC loans, regardless of market performance, there are steps that you and your clients can take to promote portfolio health.

Financial Professionals

- Consider the impact of market conditions on your clients’ portfolios.

- Consult with your Institutional Banking Business Development Officer to determine if an SBLOC and the credit-line amount is the best solution for you and your clients.

- Review your clients' SBLOC transactions and balances using our TotalCash Manager (TCM) platform. Viewing a client's transaction history can help you understand how and when they use their SBLOC.

- Consider rebalancing your clients’ portfolios to promote greater market resilience.

- Educate your clients about The Bancorp conservative lending rates and the steps we take to preserve their SBLOC collateral.

Clients

- Monitor outstanding SBLOC balances.

- Regardless of market conditions, clients can continue to use the SBLOC for their original intended purposes such as homebuying, college tuition, or paying taxes.

- Use the SBLOC for necessities (e.g., rainy day funds, unexpected medical bills, or home/car repairs).

- Consider paying off the SBLOC balance as they can reapply for the credit line in the future.

Conclusion

The Bancorp introduced the SBLOC to independent and registered financial professionals over 17 years ago, enabling them to compete with larger and more fully resourced institutions, and deliver innovative products and services to their clients.

While markets can be unpredictable, our tenured Institutional Banking Team has managed market downturns throughout the life of our SBLOC. So, whether your clients have an active SBLOC or are considering one, The Bancorp is committed to our “Always a Partner. Never a Competitor.” promise. Our Institutional Banking Team works closely and proactively with financial professionals and their clients to promote their long-term portfolio health.

1. CNBC. "The cost of goods hit another 40-year high, as gas prices continue to surge." March 2022.

2. U.S. Energy Information Administration. U.S. All grades, All Formulations Retail Gas Prices. April 2022.

3. CNBC. "Fed raises rates by half a percentage point — the biggest hike in two decades — to fight inflation." May 2022.

4. The Street. “What’s Happening to Apple, Meta, Other Big Tech Stocks?” April 2022.

5. Google Finance. VIX Index. April 2022.

6. The 50% advance rate applies to equities, while the 95% advance rate is for an all-cash portfolio.

Collateral-based borrowing may not be suitable for everyone. Consult a financial advisor about any associated risks. Consult a tax advisor for tax-related matters and an attorney for legal matters. The Bancorp Bank does not provide tax or legal advice. Rates, terms and conditions of loan products are subject to change without notice. Read all documents carefully.

Opinions, findings, or perspectives contained in this blog are those of the authors.

Institutional Banking

SBLOC

Securities-Backed Line of Credit

Market Volatility

Collateral Monitoring